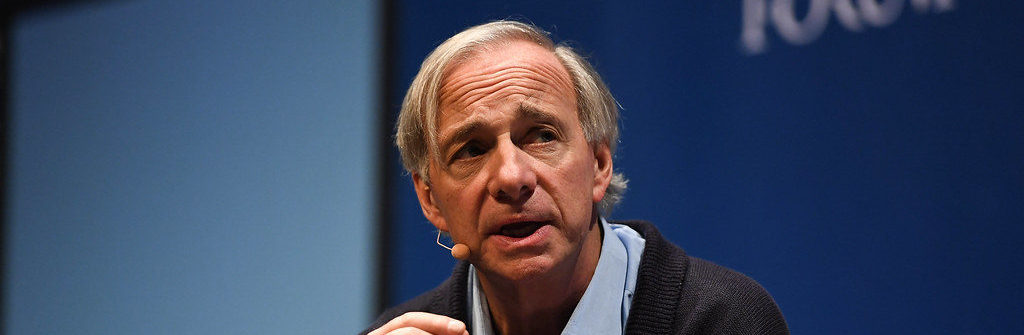

Ray Dalio has made big money off of a lot of put options he bought less than half a year ago. As the market has dropped in the midst of the Coronavirus pandemic, Dalio’s move shows us the value of using risk mitigation strategies in stock investing.

Who is Ray Dalio?

Ray Dalio is a billionaire who runs the largest hedge fund in the world, Bridgewater Associates. Bridgewater holds around $150 billion in assets and famously performed well during the 2008 recession.

More recently, in November 2019, Dalio and Bridgewater bought $1.5 billion in put options against some major indices tracking the S&P 500, mainly.

What is a Stock Option?

An option is the right, but not the obligation, to buy a stock at a certain price in the future. For example, if a stock is trading at $100, and I buy an option to purchase that stock at $95 (which expires 6 months in the future) and only can be exercised if the stock drops below that price, then I have just opened a put option position. I will only make anything off this option if the stock drops below $95 within those 6 months. If it does not, my option will expire and be worthless. Call options are the opposite. A call option only works if the stock price goes up in value. If the stock doesn’t go up enough in value, then the option will expire without value.

The option contracts themselves are tradable as well. These contracts give you the right to purchase 100 shares of the underlying stock within the time frame designated by the contract. Contract values swing up and down with even more volatility than stocks. You can think of the options market like the stock market on steroids, with drastically more risk and drastically more potential for reward.

Ray Dalio’s Massive Put Option Position

Ray Dalio’s fund bought a massive amount of put options in November 2019 that were set to expire in March 2020. They generally required about a 5% drop in the market’s prices to be executed profitably. That means if the market did not drop by about 5% before the March expiration dates, the options would become worthless by the time they expired.

The $1.5 billion in puts represented 1% of the Bridgewater portfolio at the time. Ray Dalio and the Bridgewater team believed that the market might have been due for a correction soon, so they essentially bought an insurance policy to protect their otherwise optimistic holdings. This meant that they were protecting their downside loss at the potential expense of future profits. And this is not that uncommon for hedge funds to do, which partly explains their name.

Dalio’s Bet Has Paid Off

Fast forward to today, and, wow, did they make a good call. Or, I should say, put… March 2020 has marked one of the worst stock market drops in its history. From the end of November 2019, when Dalio’s fund bought the put options, the S&P 500 dropped 5% by March 1st, 2020, and continued to drop rapidly after that, reaching a 20% drop by the end of the second week of March.

Even as the rest of their portfolio drops with the market chaos, their put options have likely saved them from an enormous amount of losses. Bridgewater has reported mixed results in their funds as of March 13th, but any losses are comparatively modest compared to the rest of the market. Granted, they do have a lot of longer term bond holdings in their portfolio, but Dalio and Bridgewater still have prevented themselves from facing a lot of the same losses that so many other people have faced in the market in 2020.

Even if the put option strategy did not work, we would still expect their portfolio to be doing well, since the market would not have dropped and they would still be making profits on their remaining 99% of their holdings. In short, using put options as an insurance policy is a feasible risk hedging strategy and potentially a very profitable one.

Who Bears the Loss?

On a similar note, Dalio definitely believes that options insurers are in huge trouble. In a LinkedIn article from March 3rd, he described what’s going on right now as “one of those once in 100 years catastrophic events that annihilates those who provide insurance against it and those who don’t take insurance to protect themselves against it.” After all, someone has to pay out those options, and many other funds will sell options that they will now be unable to cash out on due to liquidity issues. In short, the people on the other side of these very lucrative options positions are in for a world of hurt, and are probably already hurting.

Conclusion

In the meantime, we have to always prepare for the worst but keep our eyes on everything; the short, medium, and long term alike. Following great investors actions can be an effective way to remind ourselves to do that.

Using put options can be an effective way to protect against downside losses in a volatile market. Even if the options do not prove to be profitable, that would imply that the rest of your portfolio should be doing better anyways. Thinking of put options as insurance policies for otherwise optimistic allocations shows their potential for saving riskier portfolios.