This is a series tracking my progress as I try to build a $1 million net worth and $30,000 annual passive income.

Each month, I review my progress towards those goals and share my assets and liabilities in detail.

I think full transparency is very important when talking about finance. It puts vital context behind different decisions. And maybe there’s something to learn from mistakes and successes alike.

Let’s take a look at how last month went!

Buying My First Rental Property

We had a very good month.

I finally closed on my first, stand-alone rental property yesterday.

I did a full breakdown on my YouTube channel going over this rental property: the numbers, the problems I’ll be facing, and my goal with investing in this property.

The Numbers

As a quick overview – it’s a single family home in Indianapolis that is currently rented for $925 a month. I bought it for $85,000 in cash, using a combination of my HELOC funds and some cash I had saved up.

It only needs a few thousand dollars of repairs right now. Because I got it under market value, once the repairs are complete, I’d expect it to be valued around $100,000 – if not more.

With this rental property, I’ll have some financing options in the future if I want to take money back out of the deal.

Additionally, I have opened up a new stream of passive income, which will be a significant contribution to my goals.

Things I’m Keeping an Eye On

That being said, there are some problems with the property.

The biggest one is the situation with the current tenant, who I inherited from the seller. The tenant is behind on rent right now. They’ve applied for rental assistance and they’re trying to get through this next month to pay rent and catch up.

To mitigate that risk, I managed to negotiate a credit with the seller equivalent to one month’s rent with the following terms:

- If the tenant pays August’s rent, I return the credit to the seller.

- If the tenant is unable to pay rent, I keep the credit.

In short, August’s rent is being insured by the seller. It also buys the tenant some time to figure out their own situation, whether that be an assistance program or something else.

We’ll see what happens there.

In any event, the biggest appeal of this property was the fact that it was being sold for about $15,000 less than what it’s worth.

On top of that, this property could be rented at about $1,100 per month, well above the $925 it’s currently renting for.

So, despite the property having a few issues, it should work out alright. As time goes on, I’ll be able to unlock more cash flow on top of the significant equity wedge I’m getting at the start.

This investment should be a great addition to my portfolio. However, I’ll be sure to continuously update about my experience dealing with my first out-of-state investment.

With that said, let’s get into the numbers.

August 2020 Net Worth Numbers

You can view my net worth tracker for my most up to date numbers. I have also added a chart tracking my passive income throughout this process as well.

As a reminder, last month my net worth was $60,044.88.

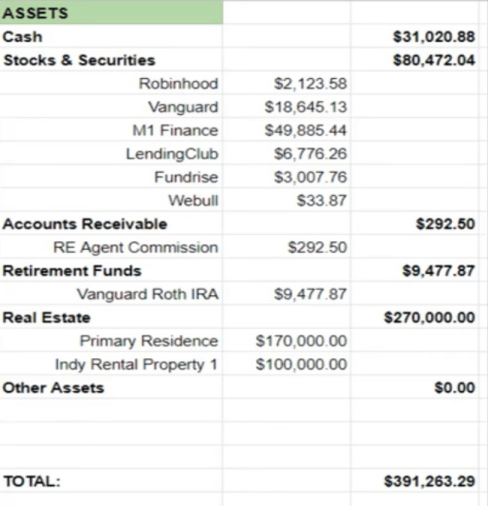

Assets – August 2020

We’re finally seeing some big changes here.

My cash pile has disappeared, with the exception of about $30,000 I have left over. This will either roll into my next deal or be used to pay down some debt.

I’ve also been pouring money into my stocks, specifically my M1 Finance account. A lot of the new additions to that have been in gold and gold stocks, which I’m using as a potential hedge against the inflation I’m expecting thanks to the Federal Reserve’s aggressive quantitative easing program. I’d intend to roll that money into a different investment when the time is right.

I’m also still waiting on one of my real estate commissions from a lease I closed a couple of weeks ago.

Obviously, though, the biggest change here is that I’ve acquired my first rental property. This investment brings my real estate portfolio over a quarter of a million dollars in asset value.

All told, I have $391,263.29 in assets.

Note: I am not including my reserves for my property in my assets nor will I be including any other reserves in the future. I’m treating those as expenses, as they are there in the event of any issues with the rental property. But, rest assured, I have reserves set aside for a rainy day and future repairs.

Liabilities – August 2020

Once again, not much has changed with my liabilities.

As I’ve mentioned before, with my credit cards, I do not hold balance through the month. I always pay down my credit cards prior to the bill, as I do not want to accumulate any interest. This is just the balance that is currently on my card, but it will be paid before interest gets charged.

I have listed the credit from the seller of my rental property. This is being counted as a liability because I will be returning it to the seller in the event that the tenant pays rent this month, and I will only keep it if the tenant does not.

In total that leaves us with $312,717.79 in liabilities.

My Net Worth – August 2020

That means our net worth is $78,545.50.

This is our biggest gain yet – $18,500.62 over last month’s.

Our debt ratio has finally dipped out of the 80’s, now at 79.93%.

And, with the new property addition, my passive income is currently at $350 per month. That number factors in estimated dividends from stocks as well.

What’s Next?

For the first time in over six months, I’m going to take a break from shopping for properties.

Given the fact that this is my first time working with a property manager, I want to make sure all of the work with my rental property gets done properly. I also want to keep a close eye on the tenant situation, to make sure it doesn’t become a bigger issue.

That said, I do want another real estate investment before the spring.

Ideally, I want to invest in something similar – a smaller rental property that I can have some equity upside in. I would also like to be able to refinance most or all of my cash out of the deal and repeat that process until I can build up a substantial portfolio.

But, as always, it will be very deal dependent. I will go wherever I think the best opportunities are for me.

In other news, at some point this month, I will also be releasing my book: The One Property Retirement.

Regardless, I will be sure to follow up about all of my real estate, passive income, and investment endeavors.

Until next month!

This website, and any communication stemming from it, while hopefully informative, should not be taken as financial or legal advice. Assume all links are affiliate links. I am an Amazon affiliate.