Over the past 35 months, I’ve been documenting my journey towards reaching two goals:

- $30,000 in passive income by 2025

- $1 million net worth by 2027

As always, you can track my progress with an up-to-date spreadsheet of my current holdings.

Business Search Update

I am officially under contract on a small business, with closing scheduled after Christmas.

A lot of my free time has been going towards that business search, which has been a very interesting journey.

In the past few months, I’ve been searching for a business.

I’ve learned quite a bit through the process of looking for a business, especially how I should not look too broadly.

I personally narrowed my search down to simple, service-based business.

Since I haven’t purchased the business yet and am subject to an NDA, I can’t go into too many details. That the business I’m scheduled to close on is in the cleaning niche.

The business under contract for under $200,000. It’s thrown off around $70,000 in cash flow over the past year and the purchase includes about $50,000 in equipment and inventory.

Very excited to keep you posted on that one!

Now, let’s get into this month’s numbers.

December 2022 Net Worth Numbers

As a reminder, my net worth last month was $83,940.72.

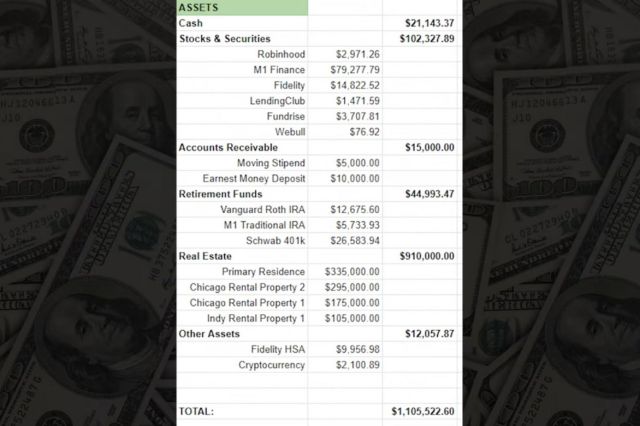

Assets – December 2022

You’ll notice a new entry: the earnest money deposit for the business that I’m under contract for.

This is just cash sitting in the escrow company’s account. If we end up going through the purchase, that money will be applied towards closing.

Our stock portfolio did not take a huge dive this month, so we still have over six figures in taxable stocks and securities.

I’m approaching $50,000 in my retirement accounts between my IRAs and my 401k.

Otherwise, pretty much everything else stayed the same on the asset side of things.

I am considering selling some stocks to shore up liquidity for the business purchase and future operations (and remove some portfolio management headaches).

That’s more of a last ditch thing, but it is on the table.

This leaves our assets at $1,105,522.60.

Liabilities – December 2022

The biggest change on the liabilities side is my M1 Finance margin.

I pulled out around $7,500 to make sure I had enough money for the earnest money deposit . I opened a new business banking account and am still moving funds around, so I wanted to have the cash quickly in one place.

I would look to pay this back pretty quickly, unless I end up needing that money to actually fund the close.

In other news, the illustrious Biden regime has decided to kick the can even further down the road with yet another extension to the student loan freeze, so we still aren’t accruing interest on our student debt.

Now that my wife is working full-time, most of her salary is going to go towards some sort of debt paydown. Naturally, we would opt for the ones that are actually charging interest now.

This leaves our liabilities at $1,001,645.27.

My Net Worth – December 2022

All in all, our net worth is $103,877.33.

That’s an increase of $19,936.61 from last month.

That leaves our debt ratio at 90.60%.

And our passive income remains at about $1,100 per month.

What’s Next? (Buying a Small Business)

When it comes to small businesses, you have some options for financing.

You can use something like a small business loan through the SBA, which can have pretty great terms compared to other types of loans for financing business purchases. You can also ask the seller to finance the purchase, where you then pay the seller over time.

For my purchase, I plan to use my personal credit to pay for my small business. I should be able to qualify for enough financing just using my personal income, which would be nice because I could close much faster.

From a risk perspective, it really won’t be all too different from using an SBA loan (since I’d have to personally guarantee an SBA loan anyways).

And I plan on paying off these loans fairly quickly anyways, as I don’t want to hold out all this debt for a very long time.

If all goes well with the purchase, I’ll be in a significantly better cash flow position.

We’ll see if it closes. See you in the next one!

This website, and any communication stemming from it, while hopefully informative, should not be taken as financial or legal advice. Assume all links are affiliate links. I am an Amazon affiliate.